God is here now, watching us.

God helps those who help themselves.

What made Japan to gasp in a slump without being able to get thorough? The reasons are obvious. As a result of abrupt financial change in attempts to push down the bubbles, prices stopped rising and the economy plunged into deflation. Suppression of speculative funds pulled down stock prices. Cutting liquidity of lands resulted in lowering the land prices. Deregulation diminished corporate profitability. Aggressive disposal of bad debts made the land prices unable to stop lowering. The employment system had been changed, etc.

Economy is not just a phenomenon affected only by volume of funds in circulation and interest rates. Business fluctuations are hammered out by multiple elements intertwined, such as the work of long term funds, fund raising capability, trend of working capitals, change in asset values represented by land prices, the stage of industrial development, and so on.

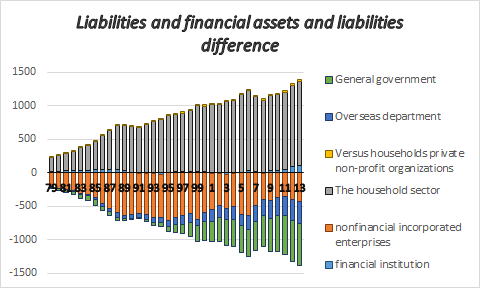

The problem was that the above measures were taken where corporate profits had originally been declined by strong yen. As a result, the direction of funds flow has clearly changed and companies transformed from deficit units into surplus units and government finance from surplus unit to deficit unit.

What you need to be careful about here is that market transactions are made up on the basis of buy-sell and loan-borrow. Considering the symmetry of buy-sell and loan-borrow and the premise that their totals are zero, where there is a deficit unit, a surplus unit is sure to arise.

In short, the question can be summarized into which unit undertakes the deficit and which unit takes the surplus, and how much accumulation is acceptable. Fixed assumption, therefore, that surplus is good and deficit is bad is not viable from the beginning. If you want to keep national finances always in surplus, the rest, either household, companies or overseas sectors must undertake the deficits.

The problem is that profitability has declined. Unless otherwise the earning power is improved, economy cannot improve no matter how interest rates are fumbled at or public investments are made.

Growth of the economy has become blunt rapidly alongside the matured domestic markets. At that time, it should have been converted from the economy of quantity to the economy of quality.

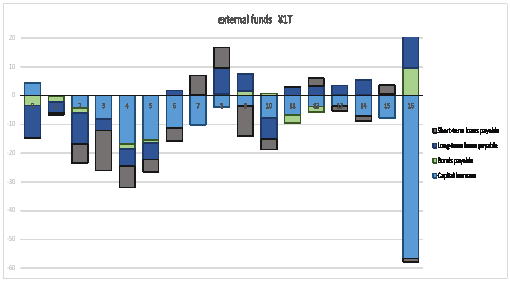

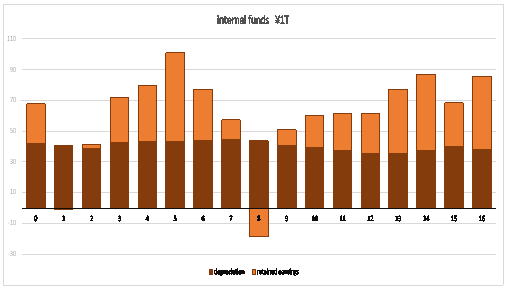

Corporate Statistics Cabinet Office

Corporate Statistics Cabinet Office

Corporate Statistics Cabinet Office

Bank of Japan

The Copyright of these webpages including all the tables, figures and pictures belongs the author, Keiichirou Koyano.Don't reproduce any copyright withiout permission of the author.Thanks.

Copyright(C) 2018.2.28Keiichirou Koyano