The System of National Accounts (SNA) consists on the premise of equilibrium which means, however the statistical and accounting equilibrium. The National Economic Statistics balance because they are institutionary set to balance in advance. The real world of economy must be predicated on imbalances. People, goods, and money are always disproportionate. People, goods, and money are not always well-balanced. There is a possibility that this point is deluded.

Current SNA is like forcing ready-made clothes provided for workers by their employer, or like Sumo wrestlers and children put in a size. Instead of forcing them to balance, we need to read the National Economic Statistics on the premise that they are imbalanced. Unless the data are dressed by the size, the environment, and the state of country’s economy, the economy may be analyzed but may not be resolved drastically. If this point is missed, the Statement of National Economy cannot be desterilized.

Trading consists of supplementing shortage of people, goods, and money, whereby shortage in a place is supplemented by overage in another. It is not always possible, however, to supplement each other's needs directly by each other’s surplus. "Money" interposes herein as a mean to complement each other. It is quite uncertain, however, when it comes to whether "money" is working to adjust the imbalance of people, goods, and money.

Roughly speaking, it is not necessarily so, that the place in short of goods has surplus money to buy them. Rather, the place lacking goods lacks money also. Then it is not easy for them to buy and supplement the goods, just because they need them. They may want to borrow money, however, in many cases they have no collateral for loans. Their SNA may look balanced, but there exist imbalances in goods and people. How to balance them is the leading challenge. SNA should really be used to construct a scheme to prevent bipolarization between regions rich in goods and money and regions lacking them.

Goods are produced and consumed, people earn and spend, and money buys/sells or loans/borrows. How to use these functions and balance the distribution of resources - that is the purpose of the trades. It is impossible to confine such challenges within the frameworks of administrative zones or currency zones in the first place. Today, there is a limit to settle them in a confined space, a currency zone or an administrative zone, like in the days of national isolation policy of Japan.

What is missing, and what is left over? Who will complement it and how? How to supplement the goods and "money" to where they are scarce - that is the primary role of the economics.

It is not possible to comprehend the meaning of the National Economic Statistics correctly without paying attention to this respect.

The problem of modern economics is on this point of attempting to make the economy stand on the Accounting Equilibrium, in short, trying to match the body to clothes instead of matching clothes to the body, which is unreasonable in the first place.

Economy is maintained on the balance of income and expenditure. In other words, the relationship between income and expenditure is directly reflected in the economy.

The Income and Production side of Gross Domestic Product (GDP) consists of Domestic-Factor Income, Net-Indirect Tax and Fixed Assets Depreciation. Of these, Net Indirect Tax and Fixed Assets Depreciation are not the income involved in the cash flow. It is Domestic-Factor Income which actually forms the cash flow. The percentage of it against the Total Production is the basis for the working of income. It is because the essence of the economy is in the distribution. Also, the Gross Domestic Product (GDP) looked at from the expenditure and consumption side are the Final Consumption Expenditure, the Total Capital Formation, and the Net Export. Total Asset Formation and Net Export are not meant to realize consumption expenditure. Therefore, it is the Domestic-Factor Income and the Final Consumption Expenditure to materialize the flow of funds.

Economy that appears on the surface of the market is made of Domestic-Factor Income and Final Consumption Expenditure. Moreover, from the viewpoint of distribution, it is necessary to see the relation between the Domestic-Factor Income and the Final Consumption Expenditure that occupies the Total Production.

National Economic Statement

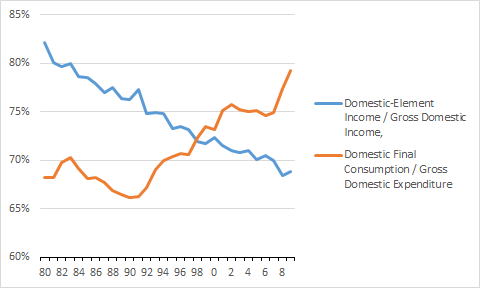

The percentage of Domestic-Factor Income in the Gross Domestic Product has been continuously declining in the 1980s, 1990s, and 2000s. This means that Real Net Income is declining. On the other hand, the Final Consumption Expenditure has risen in the 1990s, and after 1998 people spent more than they earned. What should be noted here is that income is declining both in name and reality.

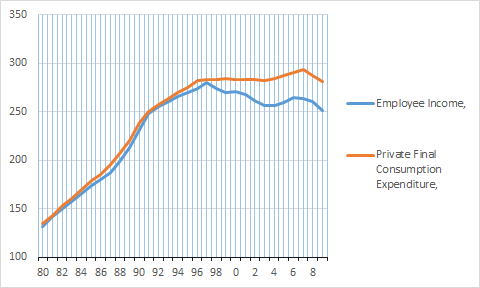

Japan’s economy can be said that the income basically exceeded the consumption in the1980s and 1990s. In the 1990s, the income remained flat while the consumption continued to rise gradually. As a result, the consumption crossed the income during 1998 to 1999 and exceeded after 2000. The intersection was between 1998 and 2000, but it seems that the turning point was in 1991.

National Economic Statement: Unit 1 trillion Yen: Cabinet Office

From the viewpoint of Private Final Consumption Expenditure, Household Real Final Consumption, and Employee Income, the Domestic-Factor Income started to decline from 1994 and Employee Income from 1995. Percentage of Domestic-Factor Income was in down trend throughout 1980s, 1990s, and 2000s while Consumption Expenditure which was in down-trend in early 1980s turned to rise from 1980s to 1990s. It stayed flat temporarily in 1999 but then turned upward.

The trend of proportions of income and expenditure in the Gross Production seems to have come from the relative relationship to the Gross Production rather than the change of nominal income or expenditure. In other words, it can be said that it shows the fact of working.

There is a critical point in the market that causes phase transitions.

When the market reaches a critical point, it moves in a different way and, in some cases, to the direct opposite direction. For example, when the markets that continued to grow have saturated, it goes toward a balanced contraction at a certain point. If we can figure out this critical point from the relationships among assets, liabilities, capital, revenues, and costs, it will be possible to control the market.

The Copyright of these webpages including all the tables, figures and pictures belongs the author, Keiichirou Koyano.Don't reproduce any copyright withiout permission of the author.Thanks.

Copyright(C) 2017.12.5.Keiichirou Koyano