A look

at cash flow analysis and correlation analysis will make the current state of

Japan's modern economy clear. Private sector companies, which had their main

business profits held down due to the high yen economic recession triggered by

the Plaza Accord in 1985, tried to find a way out by utilizing money management

techniques. Then, the sharp rise in asset values due to the use of money

management techniques brought about inheritance tax measures. But the

opportunity for money tightening was missed from the beginning with Black

Monday in 1987. For this reason, the ability to put the brakes on the increase

in asset values was lost. That was a harbinger of the bubble economy.

Due to

the increase in their asset values, companies would amass large unrealized

gains. This created an “overloan” situation for

companies. And that was the beginning of the bubble economy phenomenon.

Many

companies that had excessive loans when the economic bubble burst are not

capable of receiving new financing. For that reason borrowers have disappeared

from the market. And the general government has emerged as a borrower in the

place of the private sector companies.

And

also, even with plans to supply funds to the market with fiscal relaxation

measures, financial institutions would continue to be reluctant to finance

private sector companies that were without collateral. Therefore, no matter how

much they were wooed and beckoned, funds did not flow into the market.

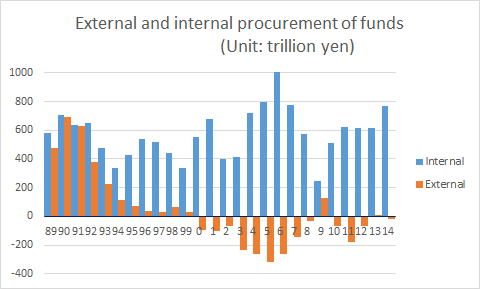

Corporate

financing shifted from external procurement to internal procurement in 2000.

Table: External and internal procurement of funds (Unit:

trillion yen)

|

|

89 |

90 |

91 |

92 |

93 |

94 |

95 |

96 |

97 |

98 |

99 |

|

External |

476 |

691 |

630 |

379 |

227 |

113 |

69 |

37 |

29 |

62 |

32 |

|

Internal |

583 |

704 |

636 |

650 |

479 |

336 |

430 |

540 |

517 |

442 |

338 |

|

|

2000 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

External |

-98 |

-105 |

-67 |

-235 |

-260 |

-320 |

-265 |

-140 |

33 |

126 |

-66 |

|

Internal |

551 |

677 |

399 |

413 |

720 |

796 |

1011 |

773 |

574 |

249 |

509 |

Statistics

of Corporations

Statistics

of Corporations

In

addition, at the same time as deregulation progresses, the profitability of

companies declines and the market moves to a state of shrinking and

equilibrium.

The

economy stops growing as the market moves toward equilibrium by a shrinking

process and funds no longer flow into the actual market.

And even

furthermore, the bottom of the market would be broken through by the strong

crush of bad debts. It can be said that, just as land started to recover, the

recovery was squelched by the crisis caused by the collapse of Lehman Brothers.

Even

though the situation might be considered a well-deserved consequence of their

actions, the performance of financial institutions degrades rapidly as

borrowers go away and interest rates decline. But borrowers do not come back

even when interest rates are reduced. This is due to the fact that the value of

borrowers' collateral has declined as their asset values declined, and also

because financial institutions have turned extremely conservative. The deposits

of small and medium size financial institutions have declined rapidly, and as

of 2017, small and medium enterprises account for 50% of financial

institutions.

This

sort of a situation is caused by the decline in asset values, not because the

private sector companies and financial institutions were managed badly.

Declines in asset value cause excessive investment, excessive debt and

excessive employment. Do not be deluded by this point. The state of the economy

must be evaluated from two aspects: the resulting economic conditions and the

factors that brought about those conditions. Considering only the resulting

conditions causes us to misjudge the essential points, which makes it

impossible to take appropriate measures. Taking your own human condition as an

example: when your physical strength is weakened because of an illness, if you

must do more things that further deplete your physical strength, your illness

will only worsen without getting better.

Private

sector companies convert their deficits to surpluses.

Table:

Liabilities and financial surplus or deficit flow (Unit: 10 billion yen)

|

|

1989 |

1990 |

1991 |

1992 |

1993 |

1994 |

1995 |

|

Private

sector non-financial corporations |

-236 |

-369 |

-413 |

-297 |

-146 |

50 |

-14 |

|

Household

economy |

363 |

459 |

452 |

514 |

476 |

388 |

327 |

|

General

government |

61 |

112 |

169 |

-16 |

-85 |

-178 |

-173 |

|

Foreign

countries |

-87 |

-54 |

-111 |

-149 |

-140 |

-122 |

-92 |

|

Financial

institutions |

-16 |

-132 |

-114 |

36 |

-36 |

-33 |

39 |

The Bank

of Japan

Funds

stagnate in the financial markets and cause inflation. In order to solve the

problem of inflation, the Bank of Japan is forced to purchase a large amount of

government bonds. In order to get funds to circulate in the market, the Bank of

Japan lowered interest rates, going to a state of zero interest rates and

negative interest rates. Even so, funds did not flow, and quantitative easing

measures were attempted.

Nevertheless,

funds were not supplied to the market. And that is the present situation.

The

measures to be taken are also clear.

Increase

the liquidity of land and increase the values of assets. Restrict certain

regulations to suppress competition and improve the profitability of companies.

Adjust interest rates and taxes to control the economy. Restrict public

investment with the aim of improving fiscal health.

The Copyright of these webpages including all the tables, figures and pictures belongs the author, Keiichirou Koyano.Don't reproduce any copyright withiout permission of the author.Thanks.

Copyright(C) 2015.9.1Keiichirou Koyano