The correlations also vary and they depend on the historical background,

scale, environment, market structure, and corporate structure.

It is

important to ascertain what it is that constitutes the foundation of the

economy.

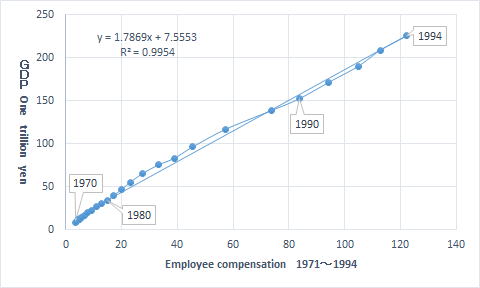

1970 to 1998

|

|

|

|

|

|

|

|

|

|

Employee

compensation |

Operating

surplus |

Gross domestic

product |

Private final

consumption expenditure |

Consumer price

index |

Sales |

|

Employee

compensation |

1.00 |

|

|

|

|

|

|

Operating

surplus |

0.96 |

1.00 |

|

|

|

|

|

Gross domestic

product |

1.00 |

0.97 |

1.00 |

|

|

|

|

Private final

consumption expenditure |

1.00 |

0.96 |

1.00 |

1.00 |

|

|

|

Consumer price

index |

0.96 |

0.95 |

0.96 |

0.96 |

1.00 |

|

|

Sales |

0.99 |

0.99 |

0.99 |

0.99 |

0.97 |

1.00 |

|

|

|

|

|

|

|

|

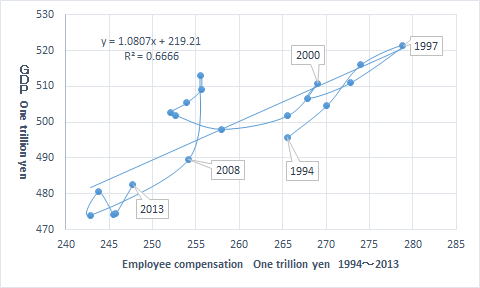

The

strong correlations that were seen from the 1970s into the 1980s such as those

between employee compensation and private final consumption expenditure,

between employee compensation and sales, between and among operating surplus,

consumer price index, private final consumption expenditure and sales, as well

as between and among gross domestic product, sales, private final consumption

expenditure and consumer price index, and between consumer price index and

sales have completely ceased to exist after 2000.

1994 to 2013

|

|

|

|

|

|

|

|

|

|

|

Employee compensation |

Operating surplus and mixed income |

Gross domestic product (production side) |

Private final consumption expenditure |

Price index |

Sales |

Operating profit |

|

Employee compensation |

1.00 |

|

|

|

|

|

|

|

Operating surplus and mixed income |

0.06 |

1.00 |

|

|

|

|

|

|

Gross domestic product (production side) |

0.82 |

0.56 |

1.00 |

|

|

|

|

|

Private final consumption expenditure |

-0.19 |

0.30 |

0.19 |

1.00 |

|

|

|

|

Price index |

0.82 |

-0.17 |

0.66 |

0.00 |

1.00 |

|

|

|

Sales |

0.15 |

0.41 |

0.42 |

0.22 |

0.07 |

1.00 |

|

|

Operating profit |

-0.41 |

0.64 |

0.01 |

0.52 |

-0.55 |

0.53 |

1.00 |

|

|

|

|

|

|

|

|

|

The economy is based on mutual relationships. If these mutual relationships

break down, the economy will not continue to function.

In other

words, economic indicators do not singly exist on their own.

They

indicate some sort of mutual relationship. These mutual relationships appear as

correlations.

To

examine these correlations, make the correlations rather than trying to find

the correlations. It is meaningful to create the correlations.

Losing

correlations degrades the economic policy and the rationality and consistency

of management. When the correlations between individual elements become weaker,

the context from economics and management will be lost.

The fact

that a correlation does not exist implies that the indicator based on the

correlation does not exist, and this means that conventional logic ceases to

apply.

Therefore,

if a correlation weakens, the indicator does not function properly.

If a

correlation does not exist, it means that the market after the collapse of the

bubble economy has fallen from its previous logical state into an illogical

space. When this happens, analysis based on conventional indicators becomes

meaningless.

1960 to 1979

|

|

|

|

|

|

|

|

|

|

Added value |

Taxes and dues |

Personal property and real estate expenses |

Interest paid |

Depreciation expenses |

Sales, general and administrative expenses |

|

Added value |

1.00 |

|

|

|

|

|

|

Taxes and dues |

1.00 |

1.00 |

|

|

|

|

|

Personal property and real estate rent |

1.00 |

0.99 |

1.00 |

|

|

|

|

Interest paid |

0.98 |

0.97 |

0.98 |

1.00 |

|

|

|

Depreciation expenses |

0.99 |

0.99 |

0.99 |

0.98 |

1.00 |

|

|

Sales, general and administrative expenses |

1.00 |

1.00 |

1.00 |

0.97 |

0.99 |

1.00 |

1980 to 1999

|

|

|

|

|

|

|

|

|

|

Added value |

Taxes and dues |

Personal property and real estate expenses |

Interest paid |

Depreciation expenses |

Sales, general and administrative expenses |

|

Added value |

1.00 |

|

|

|

|

|

|

Taxes and dues |

0.99 |

1.00 |

|

|

|

|

|

Personal property and real estate rent |

0.98 |

0.97 |

1.00 |

|

|

|

|

Interest paid |

0.28 |

0.31 |

0.15 |

1.00 |

|

|

|

Depreciation expenses |

0.99 |

0.98 |

0.99 |

0.22 |

1.00 |

|

|

Sales, general and administrative expenses |

0.99 |

0.98 |

0.99 |

0.19 |

1.00 |

1.00 |

|

|

|

|

|

|

|

|

2000 to 2013

|

|

|

|

|

|

|

|

|

|

Added value |

Taxes and dues |

Personal property and real estate expenses |

Interest paid |

Depreciation expenses |

Sales, general and administrative expenses |

|

Added value |

1.00 |

|

|

|

|

|

|

Taxes and dues |

0.47 |

1.00 |

|

|

|

|

|

Personal property and real estate rent |

0.21 |

0.02 |

1.00 |

|

|

|

|

Interest paid |

-0.22 |

0.22 |

-0.40 |

1.00 |

|

|

|

Depreciation expenses |

0.17 |

0.70 |

0.15 |

0.36 |

1.00 |

|

|

Sales, general and administrative expenses |

0.66 |

0.30 |

0.63 |

-0.15 |

0.25 |

1.00 |

What was

wrong with the bubble economy? The problem is that the correlations between the

elements that make up the market have been lost.

After

the collapse of the bubble economy, the correlations that had controlled the

market up to then have broken down.

The fact

that a correlation does not exist implies that the indicator based on the

correlation does not exist, and this means that conventional logic ceases to

apply.

In other

words, it means that the market after the collapse of the bubble economy has

fallen from its previous logical state into an illogical space. When this

happens, analysis based on conventional indicators becomes meaningless.

Correlations

are created in the market.

Unlike

physical phenomena, economic behavior must be done intentionally.

In other

words, it is natural that intentional acts exist. And that they can be adjusted

only through the will of humans. A harmonious result will not occur if they are

left alone. Put in another way, these are not random acts.

What is

important is the background that has been established by those indicators, and

the mechanisms that have been established. And what kind of functioning and

results are to be produced by changes to the assumptions of those mechanisms.

It is

necessary to confirm the assumptions that have established the indicators.

Among the assumptions that may be considered to have established the indicators

are the historical background, scale, industrial structure, systems, measures

and so on.

The

factors that change companies and the market are both internal and external

factors. The state of the economy is determined by where the internal factors

of companies and the market are, by what the external factors are at work on,

and by the correlations formed by these factors.

To

examine these correlations, make the correlations rather than trying to find

the correlations. It is meaningful to create the correlations.

The Copyright of these webpages including all the tables, figures and pictures belongs the author, Keiichirou Koyano.Don't reproduce any copyright withiout permission of the author.Thanks.

Copyright(C) 2017.6.6 Keiichirou Koyano